The Decision Ledger

Most consulting engagements end the same way: A polished deck. A roadmap. A list of recommendations.

Then nothing happens.

The advice sits in a Google Drive folder. The roadmap becomes a museum artifact. And six months later, leadership can’t remember what they paid for—only that they paid.

This is the core problem with traditional advisory models: They optimize for activity, not outcomes.

The Structural Flaw

When you pay consultants by the hour or by the project, you create an economic incentive for complexity. The longer the engagement, the deeper the analysis, the more elaborate the deliverable—the more they earn.

But your business doesn’t benefit from complexity. It benefits from clarity and speed.

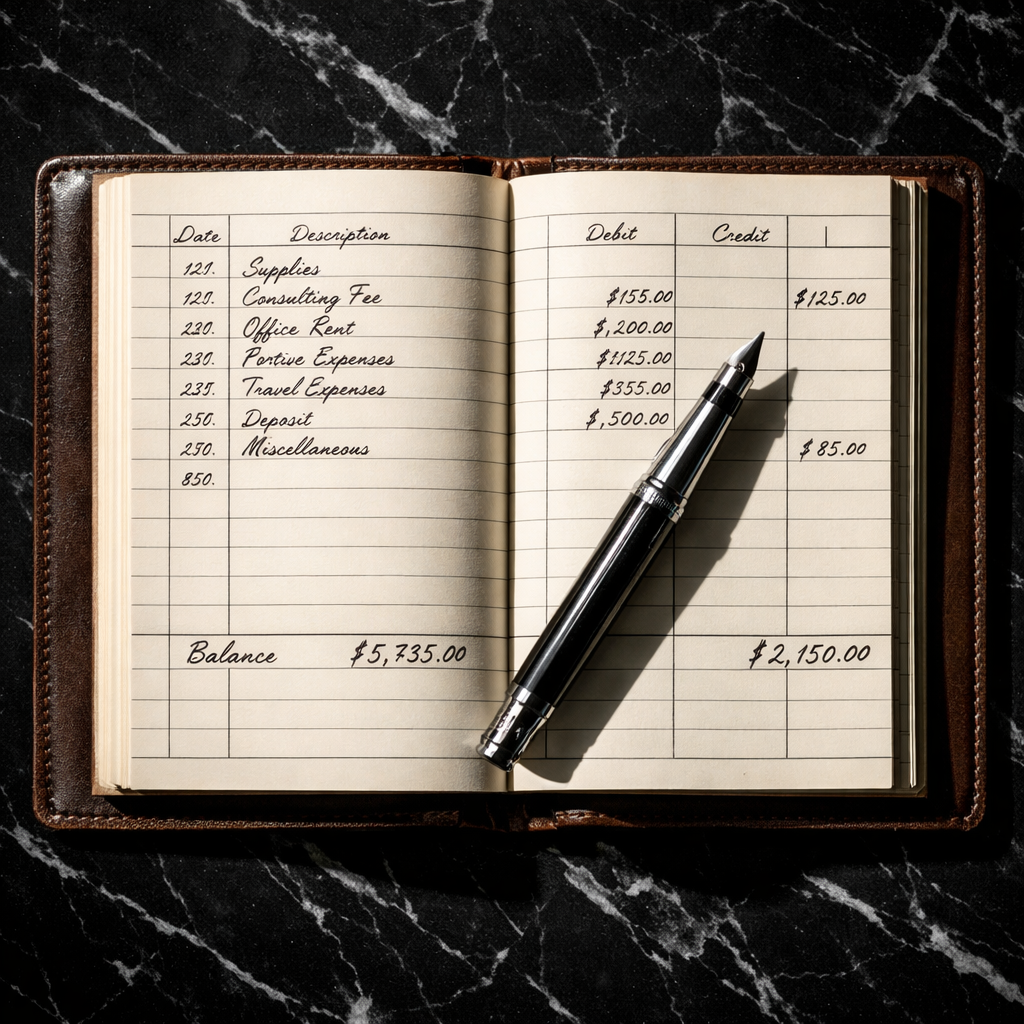

Introducing the Decision Ledger

The Decision Ledger is a living document that tracks every strategic directive we provide against two financial metrics:

The cost of the mistake you didn’t make. The bad hire you didn’t rush. The vendor contract you didn’t sign. The lawsuit you sidestepped because we flagged the compliance gap.

The efficiency gained by moving fast. The margin recovered by fixing pricing. The overhead eliminated by rightsizing systems. The revenue unlocked by shipping 8 weeks earlier.

Every decision is logged. Every directive is dated. Every outcome is measured.

If we can’t demonstrate that our guidance generated or saved more than our fee, we didn’t do our job.

What This Looks Like in Practice

Engagement: 6-month fractional CIO + systems audit

Fee: $48,000

Risk: Implementation failure, 18-month distraction

Value: 3-year savings on unused seats

Risk: Role redundancy, unclear scope

Value: Eliminated 15 hours/week manual work

Value: Annual cost reduction

Return on Investment: 13.8x

This isn’t theoretical. This is the actual ledger we reviewed with the CFO at our final session.

Why Most Advisors Won’t Do This

Because it requires accountability.

It’s easier to deliver a 60-slide strategy deck than to put your name next to a specific decision and track whether it worked. It’s safer to recommend “further analysis” than to say: “Don’t do this. Here’s why. I’ll stake my fee on it.”

The Decision Ledger forces clarity. It eliminates the performance theater that passes for consulting in most firms.

The Three Principles of Decision Velocity

The faster you make the right decision, the more value you capture. Delay has a cost. Indecision is a choice—and usually the most expensive one.

A wrong decision you make in May and correct in June costs less than the right decision you defer until November. Velocity compounds. Hesitation decays.

If your advisor can’t show you the math—the dollars saved, the risk avoided, the margin recovered—they’re selling you time, not outcomes.

What Good Advisory Looks Like

A good advisor doesn’t extend the engagement. They compress it.

They don’t create dependency. They build capability.

They don’t deliver insights wrapped in ambiguity. They deliver directives backed by evidence.

And when the engagement ends, you don’t ask: “What did we get for that?”

You look at the ledger. You see the decisions. You see the dollars. You know exactly what you paid for—and what it was worth.

Want to See Your Own Decision Ledger?

If you’re carrying strategic risk right now—vendor chaos, key-person dependency, tech debt, stalled growth—let’s map it.

First conversation is diagnostic. No deck. No pitch. Just the right questions and a clear-eyed assessment of what’s actually solvable.

SCHEDULE A DIAGNOSTICBashar Abdul-Aziz // Principal, Basharaa

Fractional CIO & Strategic Advisory for Mid-Market Leadership

Metro Boston // book.basharaa.com